* SMSF Annual Statement

* Profit & Loss Statement

* Member Statements

* Investment Reports * Trustee Resolutions & Minutes

SMSF annal return ( pension phase ) - information

16 Aug 2020 updated

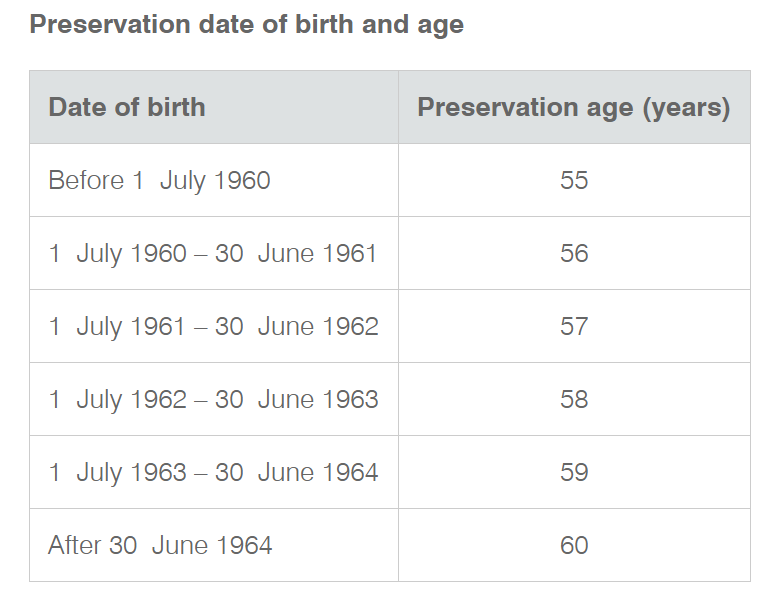

Generally your SMSF can only pay a member's super benefits when the member reaches their ‘preservation age’ and meets one of the conditions of release, such as retirement. The payment may be an income stream (pension) or a lump sum, depending on the circumstances.

Find out about:

● Preservation of super

● Conditions of release

● Death of a member

● Lump sums and super income streams (pensions)

Payments of benefits to members that have not met a condition of release are not treated as super benefits – instead, they will be taxed as ordinary income at the member's marginal tax rate. If a benefit is unlawfully released, we may apply significant penalties to you, your SMSF and the recipient of the early release.

Note that the operating standards, investment restrictions and other rules and regulations that apply to SMSFs in the accumulation or growth phase, continue to apply when members begin receiving a pension from the SMSF.